AMP Credit Loan is an online lending application that claims to offer loans at very low-interest rates.

Positioned as an easy solution for financial assistance, the app raises concerns about its legitimacy and user security.

What is an AMP Credit Loan?

The AMP Credit Loan app operates as an online platform providing unsecured loans with a maximum amount of 1 lakh rupees and a two-year EMI repayment period.

It promises an annual interest rate of 11.99%.

Despite being available on the Play Store, a critical red flag is that the application is not registered with the Reserve Bank of India (RBI) or any non-banking financial company (NBFC).

It is important to note that RedKite Technology Private Limited is listed as the company that owns this app on the Google Play Store.

Read: Ciuscar.com Review

Application Profile

| Website | – |

| Name | AMP Credit Loan App |

| Product/Services | Short Term Loans |

| Domain registration date | – |

| Address | SYSCON INSTRUMENTS PRIVATE LIMITED [email protected] Plot No.66, Electronic City Phase 1, Hosur Road Bengaluru, Karnataka 560100 India |

| Contact | +91 89172 67671 [email protected] |

Read: Dosnowwear.com Review

AMP Credit Loan Review

The AMP Credit Loan app’s potential risks far outweigh its promised benefits, making it crucial for users to avoid engaging with this platform. Here are several negative aspects that raise concerns about its trustworthiness:

- The app’s lack of registration with the RBI or NBFC raises questions about its legal standing.

- The sudden demand for repayment and subsequent threats indicates coercive and potentially fraudulent practices.

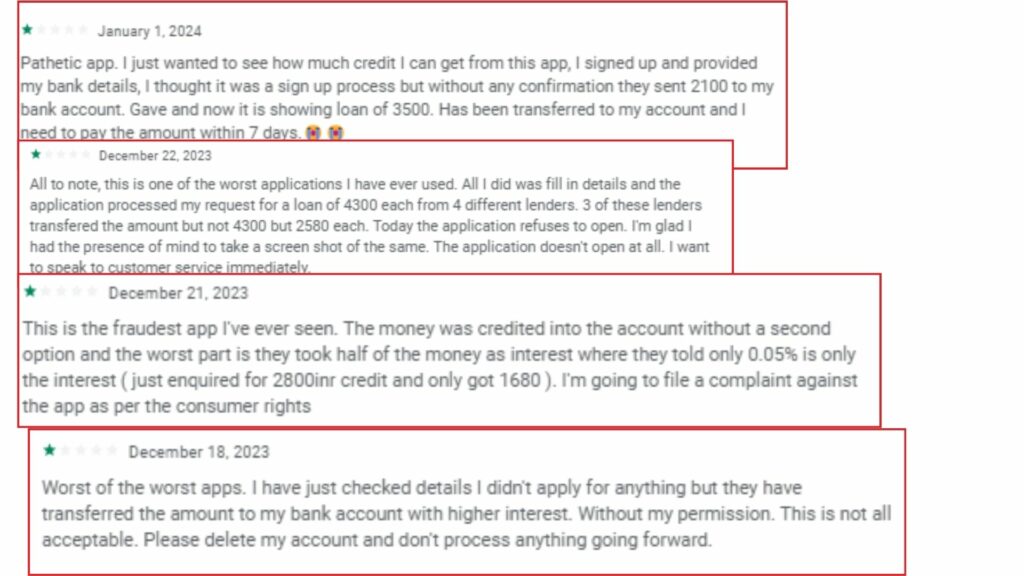

- Numerous negative reviews highlight issues with high-interest charges, threats, and overall dissatisfaction.

- Registering and providing personal and financial details on the app poses a risk to user privacy and security.

- AMP Credit Loan app raises concern by associating with different names like RedKite Technology Private Limited and SYSCON INSTRUMENTS PRIVATE LIMITED.

Users can apply for loans through the app, but alarming reports suggest a troubling pattern.

After receiving the loan, borrowers allegedly face a sudden demand to repay double or triple the borrowed amount within a short period of four to five days.

The negative reviews and potential threats associated with repayment make it an unwise choice for obtaining loans.

Users should exercise extreme caution when considering this app for financial transactions.

Read: Famoufactory.com Review

FAQs

No, the app is not registered with the RBI or any NBFC, raising concerns about its legal status.

The app claims to provide a maximum loan amount of 1 lakh rupees.

The app promises an annual interest rate of 11.99%, but users should be wary of hidden charges.

Given the security concerns and reported threats, it is not advisable to share sensitive information on the AMP Credit Loan app.

THIS APP IS FAKE AND FROUD , PLEASE NOT APPLY FOR LOAN THIS APP

I have recently downloaded the app and shareed my personal details to check my eligibility. However next day my account got credited with Rs.2400 thrice and they’re demanding Rs. 12000 now. Repayment date is on 11.02.2024. Moreover I am getting threatening messages. Please guide what to do.