In the expanding landscape of instant loan apps, caution is crucial.

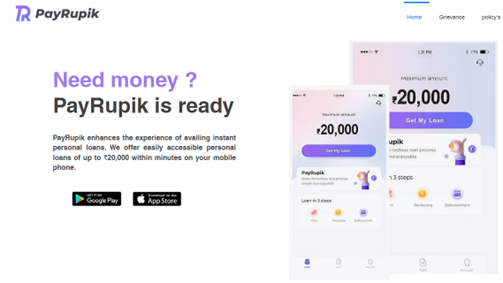

Today, we delve into the realm of the PayRupik Loan App, available on the Google Play Store, to scrutinize its features, functionality, and user experiences.

What is the PayRupik Loan App?

PayRupik, offered by Sayyam Investments Pvt. Ltd., is a loan application available on the Google Play Store with over 1 million downloads.

Claiming RBI approval, PayRupik promises instant personal loans within minutes at a purportedly lower interest rate.

According to Similar Web, approximately 4 thousand people visited the site as of October 2023.

Read: Lopebet Review

PayRupik Loan Services

PayRupik offers a loan range of ₹1000 to ₹20000. The minimum duration for a PayRupik loan is 91 days. Users can also opt for a PayRupik loan with a maximum tenure of 365 days.

PayRupik imposes an annual percentage rate of 35% per year. PayRupik charges a processing fee ranging from ₹80 to ₹2000.

To avail themselves of PayRupik’s loan services, applicants must adhere to specific eligibility criteria. Individuals applying for a loan through PayRupik should ensure that they are at least 18 years old.

Additionally, the application process mandates the submission of a selfie, along with government-issued documents like PAN cards and Aadhar cards for KYC verification.

Applicants are required to provide their bank statements to verify a stable source of income, a crucial aspect of the loan approval process.

Read: Winbuzz.in Review

PayRupik Loan App Profile

| Website | Payrupikloan.in |

| Name | PayRupik Loan App |

| Product/Services | Finance, Loan |

| Domain registration date | 3 June 2022 |

| Address | SAYYAM INVESTMENTS PRIVATE LIMITED Corporate Office: Ground Floor, Novel Office Salarpuria Triton, Adugodi, Anepalya Main Road, Neelasandra Bengaluru 560030 KA IN |

| Contact | Customer Service Number: 022489-30118 Email:[email protected] Complaint Number: 08047181465 |

Read: Ril Trade App Review

PayRupik Loan App Review

While PayRupik presents itself as a legitimate loan application, certain issues raise concerns:

- Users report facing a higher interest rate, with some experiencing an increase post-loan approval.

- Customer support is a prevalent issue, impacting the user experience adversely.

- Despite amassing over 1 million downloads, the Google Play Store lacks substantial customer reviews.

The PayRupik Loan App stands as a genuine option for those seeking quick loans. However, the higher interest rates and deficient customer support are substantial drawbacks.

The absence of extensive user reviews also adds an element of uncertainty, making it imperative for potential users to exercise caution.

Read: The Real World Review

FAQs

While it claims legitimacy, users face issues with higher interest rates and inadequate customer support.

Applicants must be over 18, submit a selfie, provide government-issued documents for KYC, and present a stable income source via bank statements.

PayRupik asserts transparency without hidden charges, but user experiences suggest otherwise.

Many users report dissatisfaction with PayRupik’s customer support, impacting the overall user experience.

Read: Rupeesnow.com Review