In this post, we delve into the realm of Ring Loan App, an online credit platform claiming to offer convenient payment solutions.

Discover whether the Ring Loan App is a reliable choice or harbors red flags that users should be wary of.

What is the Ring Loan App?

Ring Loan App positions itself as an online credit platform and application, offering users the flexibility to make in-store or online payments using loan credit.

Instead of directly transferring the loan amount to the bank, Ring allows users to shop and make purchases. Payments can be directed to the bank account through scanning options like phone, Paytm, or Google Pay.

The Ring Loan App offers a credit limit ranging from Rs. 30,000 to Rs. 35,000, depending on the user’s monthly income and profile.

To apply for a loan, users need to download the Ring app, provide basic details, and activate their accounts.

The app claims to charge 0% interest for the initial six months of borrowing.

The Ring Loan App, operated by Onemi Technology Solutions Pvt. Ltd., boasts a considerable user base and is available on the Google Play Store.

According to SimilarWeb, it has a total of 103k visitors on average as of November 2023.

Read: Praveentechy.in Review

Website Profile

| Website | Paywithring.com |

| Name | Pay With Ring, Ring Loan App |

| Product/Services | Short Term Loans |

| Domain registration date | 19 March 2022 |

| Address | 10th Floor, Tower 4, Equinox Park, LBS Marg, Kurla West, Mumbai, Maharashtra 400070 |

| Contact | 022 41434302 / 020 68135496 WhatsApp: 022 4143 4380 [email protected] [email protected] |

Read: Mangoai.co Review

Ring Loan App Review

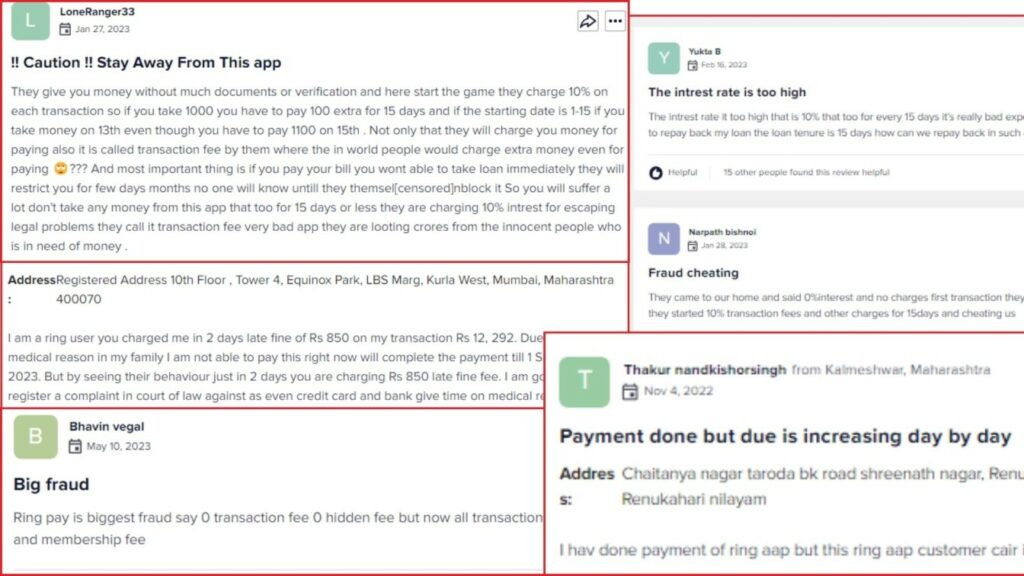

Despite its claims, the Ring Loan App appears to have significant drawbacks that cast doubt on its reliability and transparency.

Here are several negative aspects that raise concerns about its trustworthiness:

- Users have reported additional processing charges, contrary to promises of a fee-free experience.

- The app has garnered bad reviews, indicating potential issues with user satisfaction and service quality.

- Instances of data piracy have been associated with the app, posing a risk to users’ personal information.

- Reports suggest incidents of harassment and blackmail, especially when users fail to repay within the stipulated time.

- There’s a notable scarcity of information about the company online, contributing to the overall ambiguity surrounding the Ring Loan App.

Ring Loan App seems to be an actual business with known ownership and accurate addresses. With improvements, it holds the potential to emerge as a notable platform in the realm of online credit services.

However, numerous complaints about high charges, harassment tactics, and a lack of transparency raise concerns about its legitimacy.

Read: Water Sort App Review

FAQs

The loan limit on the Ring Loan App ranges from Rs. 30,000 to Rs. 35,000.

Users have reported additional processing charges despite promises of a fee-free experience.

The app claims to charge 0% interest for the initial six months of borrowing.

Instead of direct bank transfers, users can make payments through scanning options like phone, Paytm, or Google Pay.

The Ring Loan App is operated by Onemi Technology Solutions Pvt. Ltd.