In this review, we’ll examine the features and potential drawbacks of the Kredito24 loan app, a platform designed to provide instant loans for small credit needs.

What is the Kredito24 Loan App?

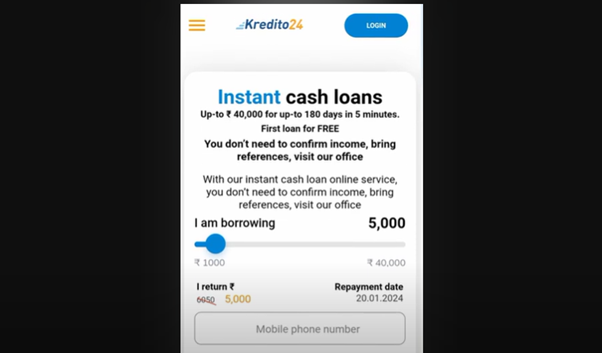

The Kredito24 loan app is geared towards addressing small credit needs, offering loan amounts ranging from Rs 1000 to Rs 10,000 per month.

The application process can be completed online through the platform’s portal or by downloading the Kredito24 loan app.

Repayment options include a single installment or daily payments over a maximum period of 28 days.

The loan is disbursed directly to the bank account of the applicant upon confirmation of the loan agreement.

According to SimilarWeb, the site has attracted around 13K visitors as of December 2023.

Read: Komeek.com Review

Website Profile

| Website | kredito24.in |

| Name | Kredito24 Loan App |

| Product/Services | Loan |

| Domain registration date | 22 February 2023 |

| Address | Corporate Name: Oneclickmoney Techplus Private Limited Shop No 97 Ground Floor, Block – BC PH 2 Mangolpuri Ind. Area New Delhi Northwest DL 110034 IN |

| Contact | +91 797 127 9014 [email protected] |

Read: Ustadjobs.com Review

Kredito24 Loan App Review

While the Kredito24 loan app presents itself as a solution for small credit needs, several red flags emerge, including harassment complaints, doubts about document legitimacy, and questions about the credibility of the operating entity.

- There are numerous complaints alleging harassment by the app to repay loans with high interest rates after a certain period.

- Concerns have been raised about the legitimacy of the provided documents by Kredito24, suggesting potential falsification.

- The app claims to be run by GSD Trading and Financial Services Private Limited, but the legitimacy of this entity is not independently verified.

- Despite claiming to be a multinational finance company, the Kredito24 website has a relatively low visitor count, raising questions about its actual reach and impact.

Users considering this platform should exercise caution, thoroughly review terms and conditions, and explore alternative options in the competitive digital lending landscape.

Read: Wishtender.com Review